The year is now officially over. It’s time for some analysis of spending and thought about long term goals.

I have no idea if you are going to be able to see that or not. If you can’t, sorry. I will improve as I do this kind of thing more.

In big picture terms Mint wants me to think I am doing worse than I am. This is partially because they are not connected to any of our investment accounts.

Noah brought home $108,959 from his primary employer. He made another $5,566 on the book he wrote. (He is checking the proofs of it right now before he “really” releases it for sales. And he’s already made that much money. My writing is just not as useful as his.) We had $7,056 arrive in investment dividends. My writing brought in a whopping $430 (I paid off the editor! That was my official goal. In another $220 I’ll break even. Oy.) Noah’s family sent us $15,075. (I feel staggered by that. Ignore that present thing. That was a bookkeeping oddity. I couldn’t figure out how to delete it. He earned $3,406 working as an assistant teacher. And we got $5,998 back from tax returns.

All total our take home income for the year was $146,491. I feel like I never get to be upset about not having enough money. If that’s not enough then nothing is enough.

I spent $120,640. So I lived within our means and saved. But not enough. Our spending is unsustainably high. This is an amount of income that we absolutely require Noah to earn. I can’t float this ship.

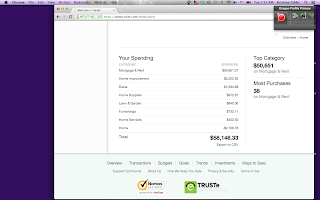

So let’s look at how all that money was spent.

Oof. Home is the big killer. I’ll break down home and look at it first.

Mortgage being $50,651.07 is slightly disingenuous. Well, or rather it doesn’t reflect our base mortgage. I paid off our time share to the tune of an extra $18,002.33. It was a 10% mortgage and I paid it off seven years early because we had the money in petty cash and now I don’t have that heinous interest hanging over my head. I have also been steadily paying extra towards our regular mortgage as well. Our base mortgage is $2100 (and change but I’m not going to look it up) and I try to always pay a few hundred extra. Now that I don’t have to pay the time share anymore I am going to roll all of the extra money into the regular mortgage. It has around $230,000 left.

The home improvement money was replacing the washer and dryer and both furnaces. That’s unusual.

The Diana experiment was a way to try and pay someone to be helpful in the ways I need help. It failed. Moving on.

Home supplies is $972.61. Often that stuff like potting soil or laundry detergent I order on the internet or a hundred other small things. This is nickel and dime money and unlikely to get lower.

With luck I won’t need to buy any more furniture in the next year or three. Oy.

Home Services I think is explaining the exterminator. Worth every penny.

Lawn & Garden is the nice man who cleans up my messes and keeps my bushes from blocking the front walkway. He doesn’t have to do much. He always seems weirded out by how little I want him to do. I’m thrilled with the help.

I’m not entirely sure why I have a negative payment in this section. It’s A Mystery. And my internet connection is being flakey (as usual) so the page isn’t loading for me to find out. But the next page loads. The internet isn’t sure if it loves me or not.

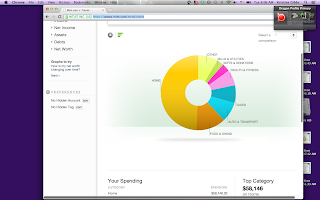

I’m going to show you the overall breakdown in a pie graph. Because Mint is cool.

I’m not going to bother showing you a screenshot of the next section.

Food and drink! $11,027 spent on groceries and $4,174.71 on restaurants. Given how ridiculously well we eat I can’t complain about it. Not really. We eat remarkably good food.

Then Auto & Transport. 104 transactions resulting in a total of $10,226.34 spent. A bit over $5,000 of that was fixing the car after the deer jumped on the car. That’s an act of God. Then we spent $2,563.15 on gas. Not bad. Just over $200/month is what I was aiming at. Just under $900 on other car repair stuff. Insurance is $643.49 for the year. I spent $551.00 on public transit (that saves a lot in gas). Registration for the vehicles was $426. I spent $131 on parking. Though honestly a lot of that was Noah going to the city for work stuff.

So this category feels ridiculously inflated but that’s a blip. An unavoidable blip. A blip that causes me to be glad I have savings.

Taxes are $8,997.88. That category isn’t really just taxes. I should rename it. It is property tax and home owners insurance and life insurance on both of us (a million for Noah, a quarter of a million for me) and occasional bursts of health insurance payment stuff.

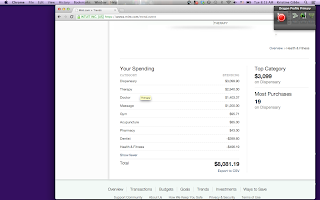

When I say I believe in accountability I am serious.

Health & Fitness. My nemesis. I spent $3,099.90 on pot. That makes me feel bad about myself. Over $1500 of that (almost $1700, really) is the two months before the marathon when I went entirely on edibles. That’s why I don’t eat my pot. I can’t afford it. That two month stretch was as much as another eleven months of smoking. And that was smoking at a significantly higher rate for most of that time than I have been in the last few weeks. I want to bring this down because I would rather not have it as a line item. Unfortunately my anxiety doesn’t give a shit.

$2940 on therapy is because I was without a therapist for a lot of the year. This will be higher this year. Gulp.

$1403.37 on doctors. Most of that on some liver panels for Noah. I want to keep him.

$1200 on massage and I kind of wish I had spent more. I love my massage therapist so much. He helps make life worth living.

Gym: $95.71. We don’t go enough. We rarely go. But that isn’t much for a year and Noah and I both enjoy going to the gym together. And we will never again get gym membership for this cheap. We figure that if we pay for four or five years we don’t use much but once the kids are bigger we resume usage it will be well worth it. I hope it works out. Sigh.

I’m not sure how I ended up negative in dentist. That seems odd. I guess I overpaid for procedures before insurance kicked in? And the other negative one… that screen isn’t loading. Once again. It’s A Mystery.

Back to the overall pie chart.

I spent $4,053.37 on gifts. That includes shipping things to people far away. That is all Christmas and birthdays and charity donations too. I would be surprised if this is long term lower than this. In the future I hope that charitable contributions will be higher so this section may increase. I want to break it down and track it better in the future.

Bills include phones, electricity, water, trash, etc. $3, 607.36 is just about exactly perfect for the $300/month I budget. Woo.

“Shopping” is a mish mash. The kids are fighting so I’m not going to try for another screen shot. It includes cash, clothing, books, electronics, etc so $3,068 is probably where this will consistently stay.

Kids got $2,379.70. So, less than $200 every month. That was for clothes, toys, lessons, memberships, etc. I feel like I can’t possibly make this lower and it is likely to get higher. Gulp.

Business services were things for Noah’s contracting. This will be variable.

$253 on my cat. She’s worth it. And getting old.

$168.55 on fees and charges. Otherwise known as the “Krissy is stupid sometimes about handling things so she gets banged.” Sigh.

So I spent $118,318.78. I don’t feel too bad about that.

For next year I don’t think I can sustain $50,000 towards mortgage. It would be really nice, but I told Noah I would rather have him work less and make less money for this year. So I’ll set my sights lower. My base mortgage is around $26,000. I want to make that a square $40,000 next year. Cross your fingers.

If I don’t need to repair any major appliances next year (the only thing left is the dishwasher and I hope I can eke out at least one more year–we’ll see) and no large animals jump on me then my spending will be at least $20,000 lower less year. Which will place us under Noah’s take home salary for his primary employer.

I feel like I was not as frugal as I could be. I have also been dealing with a lot of grief and I do sometimes do retail therapy. Overall I’m not a big fan but sometimes it works. Given that I am keeping us within our limits and overpaying the mortgage and we are maxing out the 401k I don’t feel as guilty as I could. I feel some guilt about not contributing to the 529 this year. It’s only around $30,000. (I don’t remember for sure and that paperwork is somewhere else.) I had hoped it would be at $50,000 by next year but I don’t think that will happen. It’ll work out. Paying off the mortgage first is a good idea in my opinion. I know that other people think we should be investing more but given what the stock market has done in my lifetime I’ll pay down my mortgage first, thanks.

So I don’t feel ashamed but I don’t feel like this was one of my more self-disciplined years in terms of spending money. That’s ok. You can’t be perfect all the time. I made substantial progress towards my goals. That’s good enough for government work.