Every year I like to do a financial review. I post them publicly because I… have trouble finishing things people won’t see. It is an unfortunate personality quirk. But, I have learned how to work around it and thus I post an annual review. This is my third. The previous two for 2013’s spending and 2012’s spending are through those links.

A brief glance at 2012 tells me that my mortgage is about $50,000 lower than it was. Oh that feels good. Beyond that glance I can’t review those entries. Wow they got long. Let me delve into this year instead.

I’m going to start with income and move on to other bits from there.

Right away you see how things look funky. It looks like Noah got less in his paycheck than I expected, but that isn’t so! Really what happened is he got a bunch of unexpected money and I spent pieces of it and there is no way to put that in the budget without bumping up the paycheck section. I don’t like this tricky way of trading accounting, but given that his extra income is a full $68,633 over and above our spending for the year I am having trouble properly flogging myself for going over his base income. I mean really, that’s a full time job of income I didn’t even count as income in our budget. It’s ok that I fudged into it.

So his primary job payed him $144,359. Holy shit. That would never happen to me. Go Noah.

He made $6,440 on his book this year. This is the same book that has been out for a while. Notice how there is no line item for my writing? I try to believe I contribute in other ways.

Dividend income is just investment odds and ends that sit in an investment account waiting to reinvest.

He made $2,014 from his “second job”. On top of the writing. Because he likes working.

“Noah’s Mom’s $” is actually a pay out from a term life insurance policy his family had for him when he was a kid. Keeping it as a separate account was kind of a pain so we cashed it out.

“Investment income” is mostly money from one of his former companies getting bought. That was about $35,000. (Yay!) Another $10,656 came from old family investments. The rest was just small earnings on investments that were reinvested.

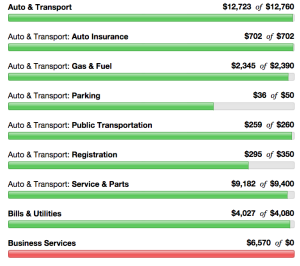

Then we have the first section of spending!

Business is red because Mint doesn’t have a way of categorizing “This spending comes out of this other checking account” so I don’t add it into the budget. But I do money transfers to equalize between the primary checking account and the business account. I’m going to need a better system one of these days. It is working so far.

Wow fixing the cars was expensive this year. The cars are both 2006 vintage so this is expected. This kind of thump to the wallet is why I leave so much of “income” invisible so I have reserves when things break. Ouch.

We spent less than $200/month on gas. Not terrible! I tried hard to reduce my driving this year.

Neither Noah nor I have expensive hobbies. We don’t do a lot of idle personal spending. I was a bastard and I put books in their own category instead of pulling our personal money for it. Feels like cheating. But man, if we don’t build up that “fun” personal budget we don’t do *anything* fun. I have a grief ritual coming up that isn’t cheap. Saving up is smart. Noah is running off with buddies next month.

We spend a little under $500/month on restaurants. Wow that seems obscene. I’m grateful for my privilege.

Groceries were $14,140. So just under $1200/month. That feels less bad to me because I know how many other people we feed. I also know that my grocery budget is inflated by $1200 because I bought a gift certificate for a grocery place. It bought me $1500 worth of groceries for next year. I’m ok with the trade.

$3,000 on gifts and donations. Breaking that one down into subsections would take a lot of work. I suspect that in my opinion we didn’t donate enough and we spent too much on presents.

Wow we spend a lot of money on health and fitness ($15,899.20). That covers massage for Noah and I ($4,850)(I think we are both much happier when we are getting body work), dispensary ($4,573) [that came down!], therapy ($3,000) and gym/dentist/doctor/etc for the rest. Noah says I am an expensive pet and he’s not wrong.

Home was 37% of our spending this year. 73% of that was mortgage. $41,007.70 went to the mortgage. Watch me do my happy dance. Noah says we got a tax paper in the mail that says only about $8,000 was for mortgage interest. Oh watch my happy dance. At this point our mortgage is in the low $180,000’s. Not sure exactly where because I can only look it up when I have an active bill in bill pay. Weird. I think it is funny that by the time I finish writing the paragraphs, the screen shots aren’t right. I had a bunch of duplicate checks listed in this section. Glad I caught that. We spent $7,000 on the handyman. The rest is home improvement (we did fix our furnace, replace our dishwasher, and hire a plumber recently on top of gardening, etc.) (I did go back and fix the screen shot. That was very wrong.)

I love the pie charts. Aren’t they cute? I wish home was a higher percentage of our spending. I am totally spending money in other sections at an accelerated rate.

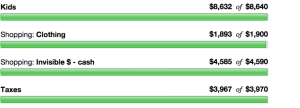

A full 25% of the kid spending is babysitting. I spent $1600 on “toys” but that includes school supplies sometimes and we are home schoolers. Clothes/books/allowance/activities round out the rest. I don’t regret the amount. If we had the kids in charter schools we would only get $3000 from the state. Doesn’t seem worth jumping through hoops to me. Because I would have to put up with hoops. Privilege is freakin awesome.

$1900 for clothes for Noah and I and a lot of the kids stuff gets put in here when I feel like I’m maxing out their section. That’s not hideous.

I wish I was better at tracking my cash spending. Almost $400/month is ridiculous.

Taxes! Can’t escape those bastards.

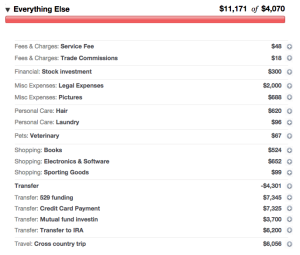

Last…. the “everything else”.

Err, a lot of the legal expenses will come back. Probably like $1500 because we didn’t spend long in court. That lawyer was worth every penny. I decided not to slam Noah for haircuts. Ain’t fair he is the only one who gets them. Wow pictures are expensive when you pay a professional. The cross country spending so far looks heinous but it will pay off. Yay trailer! (And other stuff. Lots of other stuff.)

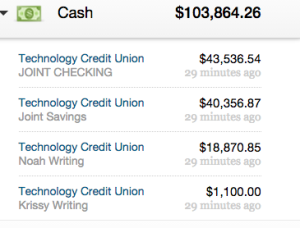

Lots of cash at the end of the year.

Next year we are remodeling the bathroom and I’m going on a cross country trip. We’ll go through cash. I have a mortgage to pay off. Cash will get spent. Noah’s Writing checking account is where we are saving towards the full year round the world trip. I think we will need a minimum of $60k for that.

I’m really impressed with Noah’s ability to earn money. I don’t have the ability to make money show up like this.

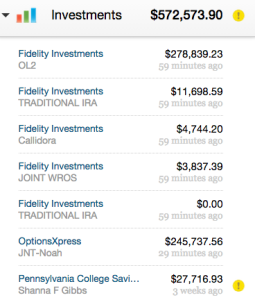

I feel somewhat confident that we won’t be eating cat food through our golden years even without Social Security. Long way to go before we get to where we want to be. Soon I’m going to stop contributing to Shanna’s 529 entirely. We want in the neighborhood of $50k per kid in 529s and the other $50k/kid in other types of accounts. We want to be able to give each kid $100,000 to make their way in the world or for college. Given that they are 4 and 6 I think that having over $32k is pretty good. Not there yet, but working on it.

My childhood dream was to someday own a house I had paid off and have $250k in investments. Doing really well.

Thank you Noah. I’m grateful to have you as a partner. I hope I’m managing your income in a way you feel is responsible.