It’s bad. So bad. This year… everything blew up financially. So much money was blown. So much. Oh I’m not happy with myself. Here we go. I have to honestly account for it. Fuck.

First, I want to say that if you screw something up one month in Mint (like, by expecting way more income than you get in a month) it’s hard to fix that in later months.

This is reversed from how I want it to look. Sigh.

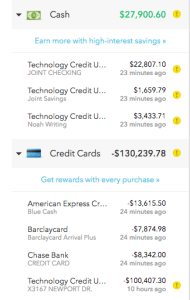

That’s what I call “not good”. $27,900.60 in cash and a whopping $130,239.78 in debt between credit cards and the HELOC. That’s not good. This is why we are going to arbitration. Hopefully we will get a chunk of change back and all of that credit card debt will evaporate and a big chunk of the mortgage. With luck. Let’s see if that dude who read my astrological chart was right. He said I will always win when it comes to money in court. Let him be right.

I think he mostly wanted to get laid.

Anyway.

I’m digressing because would you want to delve into how things got like this? Probably not. Well I don’t want to either. Here’s a trend view for you.

The bestest thing I can say about that pie chart is that I spent more than 50% of my spending on home spending. That was kind of a goal. Given that it was competing with the vow renewal and a couple of surgeries… Excellent. I did keep pace with that priority.

Then a whole bunch of that might come back and it will look like I spent more like 43% of the year on home spending. Don’t judge.

So I can succeed and fail at the same time.

Here is what that looks like broken down:

Holy crap for crisco. This is my life. We spent… an obscene amount of money. Holy tomato. And we aren’t done. Out of that $213,620.84 spent on “home” $127,802 went towards the bathroom remodel. We are hoping to get $70,000 (approximately) back from the arbitration. The lawyer has been over $9k so maybe we can deduct $60,000 from what was spent on the bathroom remodel bringing it down to a more reasonable $67,802 for the remodel? Maybe? Ok, that’s just a pipe dream at this point… but if we win on the arbitration then the bathroom will cost more like what I wanted to spend. $60k-$80k.

We’ll see. No news on how the rescheduling is going if it is going to be rescheduled. Wheeee. (Long story. Opposing party hired new council at the last minute and is attempting shenanigans.)

So we spent $72,508 on mortgage this year. That’s progress towards a goal. Awesome. I’m thrilled.

That leaves another $13,000 spent on home stuff. Oh goodness. Yeah… that’s a lot of home maintenance stuff. Freakin everything broke this year. I made progress on fixing a bunch of stuff. I spend money on amending dirt every year. Living in a swamp kinda sucks.

Given that I initially asked Dark Garden if I could have an outfit for $8-$10,000 and I walked out of there spending closer to $30,000 it makes a lot of sense that the vow renewal was twice as expensive as I wanted it to be. My initial budged had been $20,000. And then the clothes. We didn’t really earn money back for the cross country trip, but my credit card lets me cancel out travel expenses at a higher rate of return per point spent and it has to be recorded somehow.

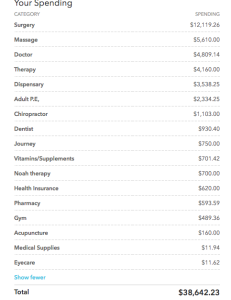

This next section is a break down of health.

My experience of paying for child birth is I should expect about $10,000. That means $38,642.23 is probably not that far out of line for what to expect for next year. I should plan about $3,000/month. Oh wow.

I’m so lazy I can’t be bothered to track down that one lonely coffee shop purchase to make things align with my normal categories.

When my house is exploding with chaos we eat out a lot. Having to stop work to make work to clean up work before I can return to work… wears me out. That’s what making food feels like. So we eat out a lot. And just generally… wow that’s a lot of money on groceries. We eat well.

Kids. I might write more but I have a kid chattering my ear off and I can barely think.

Part of the reason that their activity section is so high is because we paid two years of an activity mid-year. Our babysitter got a good sized Christmas bonus, she didn’t quite work hard enough to earn all that. But if everything were fair she earned twice that so whatever.

Shopping is the next chunk of the pie.

I don’t feel good about having that much uncategorized money. I also haven’t had the time or mental bandwidth to be more careful this year. Being rich is so god damn awesome. I feel guilty taking advantage of my buffer but this year I have to the limit.

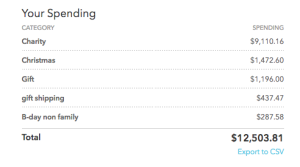

Gifts and charity:

That’s not what I want it to be going forward but we’ll figure it out.

When I feel like I’m completely failing at meeting my financial goals and I need to stop being such a god damn slacker I remind myself… this is my net worth.

It’s ok to fuck up sometimes. I’m doing ok. Am I doing perfectly? There is no such thing. I’m doing ok.

I could be more detailed but I also could be painting. Bye 2016.